eth crypto prediction Insights into Ethereums Future

eth crypto prediction sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail. As one of the leading cryptocurrencies, Ethereum has captured the attention of investors and tech enthusiasts alike, thanks to its innovative smart contracts and unique blockchain technology. Understanding the dynamics of Ethereum's market performance and what lies ahead can provide valuable insights for anyone looking to navigate the crypto space.

This exploration covers various aspects of Ethereum, including its current market trends, price influencing factors, and expert opinions on its future potential. With a deep dive into technical analysis and community sentiments, this discussion hopes to paint a comprehensive picture of where Ethereum is headed in the evolving landscape of digital currencies.

Overview of Ethereum and Its Technology

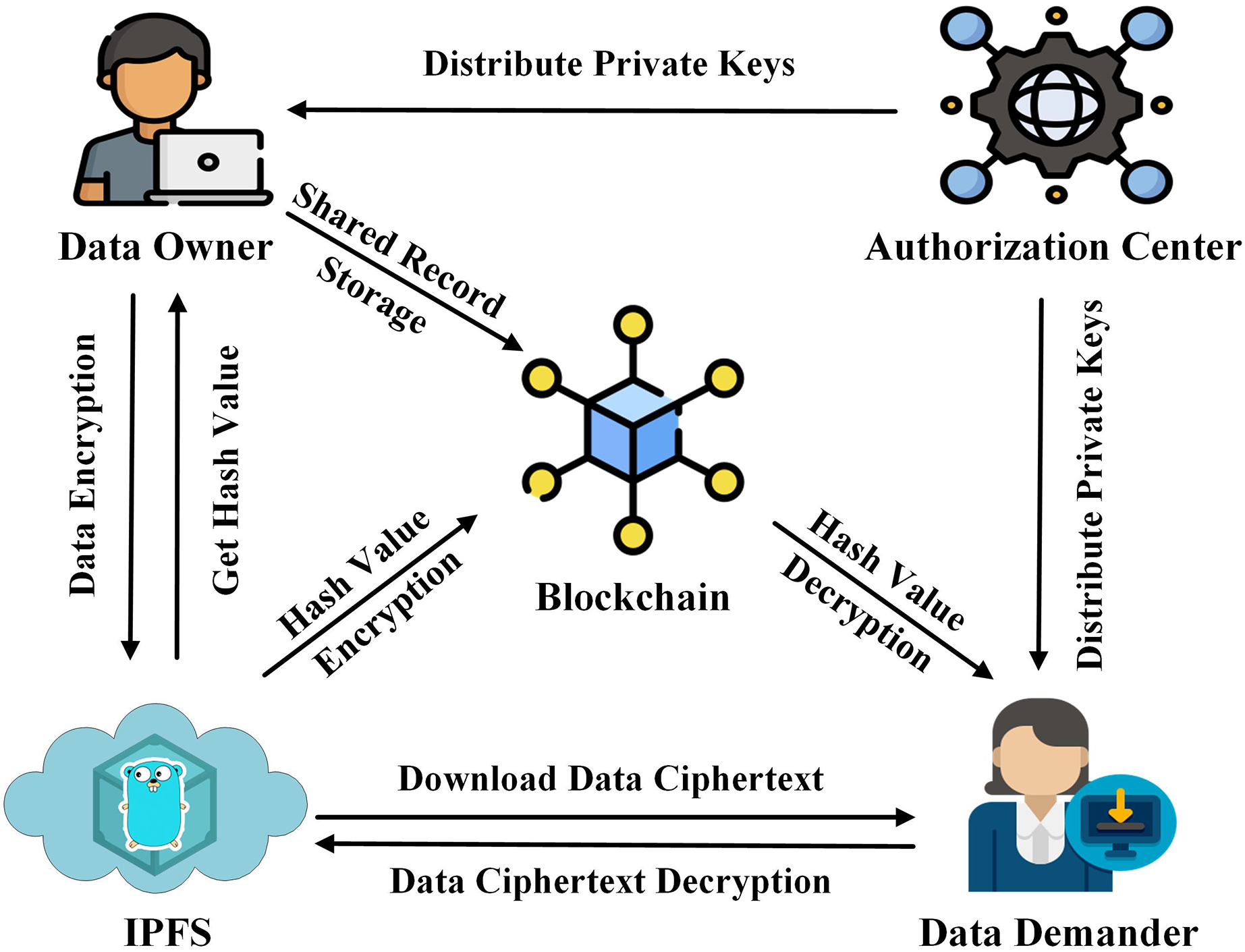

Ethereum, founded by Vitalik Buterin in 2015, stands as a revolutionary blockchain platform that extends beyond the capabilities of Bitcoin. Its core technology revolves around a decentralized network that supports the creation of smart contracts—self-executing contracts with the terms of the agreement directly written into code. This innovation allows developers to build decentralized applications (dApps) that can operate without intermediaries, ensuring greater transparency and security.The significance of smart contracts in the Ethereum ecosystem cannot be overstated.

They enable a vast array of functionalities, from financial transactions to complex decentralized governance systems. Moreover, Ethereum's unique features, like its ability to facilitate rapid token creation and its programming language, Solidity, set it apart from other cryptocurrencies. Unlike Bitcoin, which primarily serves as digital gold, Ethereum's multifaceted use cases make it a cornerstone of the decentralized finance (DeFi) movement.

Current Market Trends of Ethereum

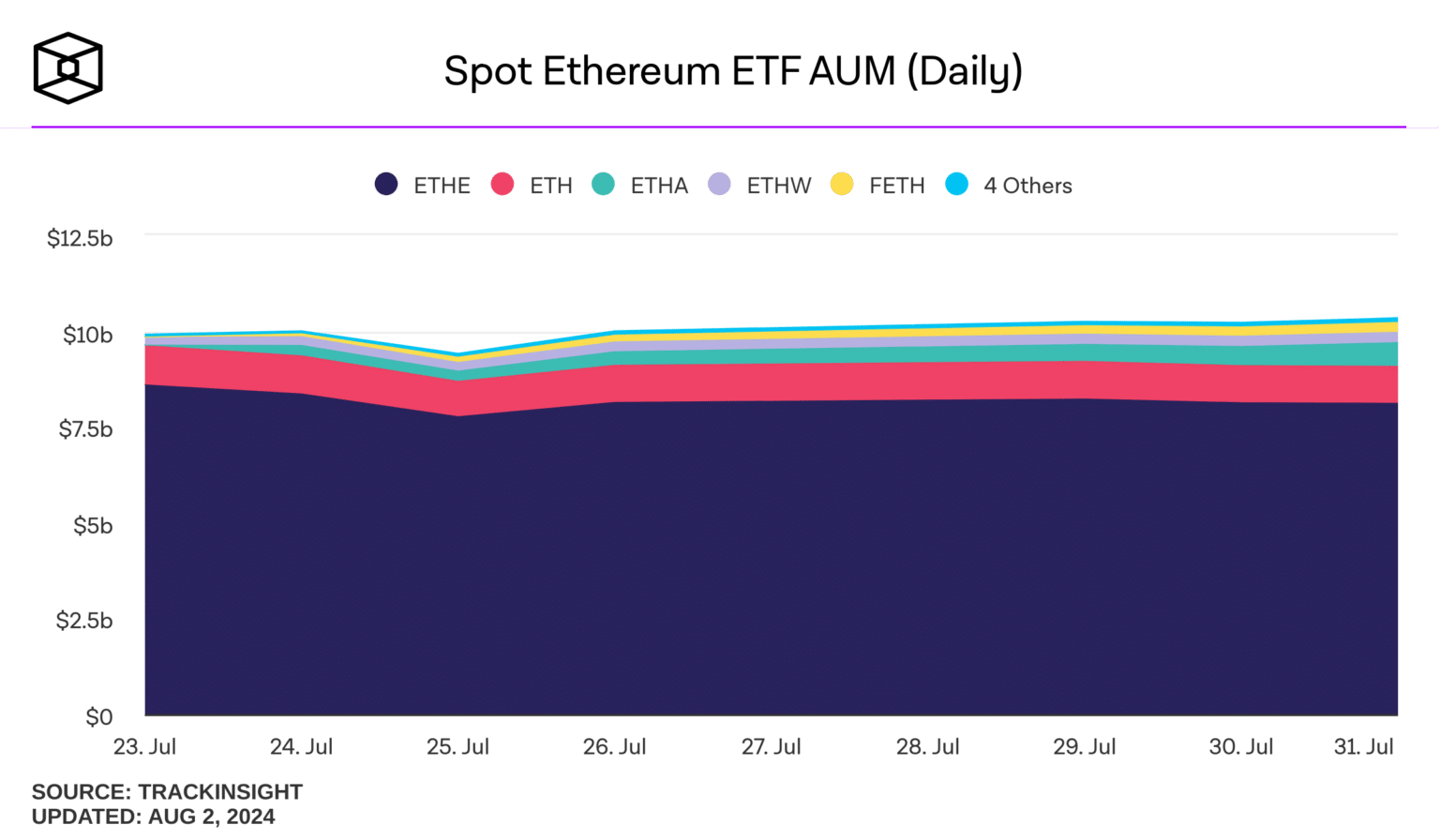

Currently, Ethereum's market performance indicates a robust recovery post its 2022 lows, with increasing adoption among institutional investors. Over the past year, Ethereum's price has shown significant volatility, peaking at around $4,800 in late 2021 before experiencing fluctuations. As of now, it hovers around the $3,000 mark, reflecting both investor sentiment and market trends.Recent statistics reveal that Ethereum's market capitalization is consistently one of the top two in the cryptocurrency space, often competing closely with Bitcoin.

As of October 2023, Ethereum's market cap stands at approximately $350 billion, highlighting its dominance and the growing interest in its technology.

Factors Influencing Ethereum Price Predictions

Several factors play a crucial role in determining Ethereum's price. Market demand and supply dynamics are foundational; increased interest from retail and institutional investors tends to drive prices up. Additionally, regulatory changes significantly influence market perception and, consequently, Ethereum’s price. For instance, any announcements regarding the legal status of cryptocurrencies can lead to swift market reactions.Macroeconomic factors, such as inflation rates and global economic stability, also impact Ethereum's valuation.

A rising interest rate environment may drive investors toward traditional assets, while economic downturns could lead to increased interest in cryptocurrencies as alternative stores of value.

Technical Analysis for Ethereum Predictions

Technical analysis is a common method used by traders to predict future price movements of Ethereum. Traders often rely on various indicators to gauge market sentiment. Key tools include moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels.

| Indicator | Description | Use Case |

|---|---|---|

| Moving Averages | Calculates average price over a specific period | Identifying trends and potential reversal points |

| RSI | Measures speed and change of price movements | Determining overbought or oversold conditions |

| Fibonacci Retracement | Identifies support and resistance levels | Predicting retracement levels in a trend |

Historical price patterns, such as the "double bottom" or "head and shoulders," have also proven to be reliable indicators of future movements, reinforcing the importance of technical analysis in making informed predictions.

Expert Opinions on Ethereum's Future

Industry experts express optimism about Ethereum's future potential. Many analysts predict that Ethereum could see substantial growth, especially with the transition to Ethereum 2.0, which promises improved scalability and reduced transaction fees. Projections for Ethereum's price in the next five years range from $5,000 to as high as $15,000, depending on market conditions and advancements in its ecosystem.Bullish analysts argue that Ethereum's consistent development and strong community support position it well against competitors.

Conversely, bearish viewpoints cite potential regulatory hurdles and market saturation as risks that could hinder growth.

Ethereum vs. Competitors: A Comparative Perspective

Ethereum faces competition from various blockchain platforms, including Binance Smart Chain, Solana, and Cardano. These competitors have carved out their niches, often emphasizing scalability and lower transaction costs. Advantages of Ethereum include:

- Robust developer community and vast array of dApps.

- Established reputation and first-mover advantage in smart contracts.

- Continuous upgrades and enhancements, such as Ethereum 2.0.

Disadvantages might involve:

- High transaction fees during peak usage times.

- Scalability issues that are being addressed but still present.

Community Sentiment and Its Impact on Predictions

Community sentiment plays a pivotal role in Ethereum's market performance. Enthusiastic discussions on social media platforms can significantly influence investor behavior, creating trends that lead to price fluctuations. The correlation between social media trends and Ethereum's price movements has become increasingly evident, with platforms like Twitter and Reddit acting as barometers for community sentiment.

"The community believes in Ethereum's potential to redefine finance and governance, making it a focus for both speculative and long-term investments."

Recent conversations among Ethereum supporters highlight the excitement surrounding upcoming upgrades and partnerships, reflecting a bullish outlook for the platform's future.

Future Developments in the Ethereum Ecosystem

The Ethereum ecosystem is poised for transformative technological upgrades, notably the shift to Ethereum 2.0, which introduces proof of stake and sharding to improve scalability and sustainability. These developments are expected to bolster Ethereum's appeal and usability.Several projects and partnerships are anticipated to drive growth, including collaborations with enterprises and integration with decentralized finance protocols. A timeline of significant upcoming events includes:

- Launch of Ethereum 2.0 in late 2023.

- Partnerships with major financial institutions in early 2024.

- Integration of Layer 2 solutions throughout 2024, enhancing transaction efficiency.

Wrap-Up

In conclusion, the future of Ethereum remains a captivating subject filled with potential and uncertainty. By examining market trends, expert analyses, and community insights, we've uncovered a complex web of influences that shape Ethereum's price predictions. As we look forward to the upcoming developments within the Ethereum ecosystem, staying informed will be key for investors and enthusiasts eager to capitalize on the opportunities that lie ahead.

Commonly Asked Questions

What is the current price of Ethereum?

The price of Ethereum fluctuates frequently; it’s best to check a reliable financial news source for real-time updates.

How can I invest in Ethereum?

You can invest in Ethereum by purchasing it through cryptocurrency exchanges like Coinbase or Binance.

What makes Ethereum different from Bitcoin?

Ethereum enables smart contracts and decentralized applications, while Bitcoin primarily serves as a digital currency.

Is Ethereum a good long-term investment?

While many analysts believe in Ethereum's potential, it’s important to conduct thorough research and consider market volatility before investing.

What factors can affect Ethereum's price?

Factors such as market demand, regulatory changes, technological advancements, and macroeconomic trends can all influence Ethereum's price.