Which ethereum etf is best for savvy investors today

Which ethereum etf is best opens up a fascinating conversation about the investment potential of Ethereum-based exchange-traded funds. These financial instruments provide investors with a unique way to gain exposure to Ethereum while diversifying their portfolios. As the cryptocurrency landscape continues to evolve, understanding the nuances of Ethereum ETFs becomes crucial for making informed investment decisions.

This overview will explore the different types of Ethereum ETFs available, the regulatory environment impacting them, and the criteria that investors should consider for effective evaluation. With a rising interest in Ethereum, navigating this space can be both exciting and complex, making it essential to grasp the fundamental aspects that define the best options on the market.

Overview of Ethereum ETFs

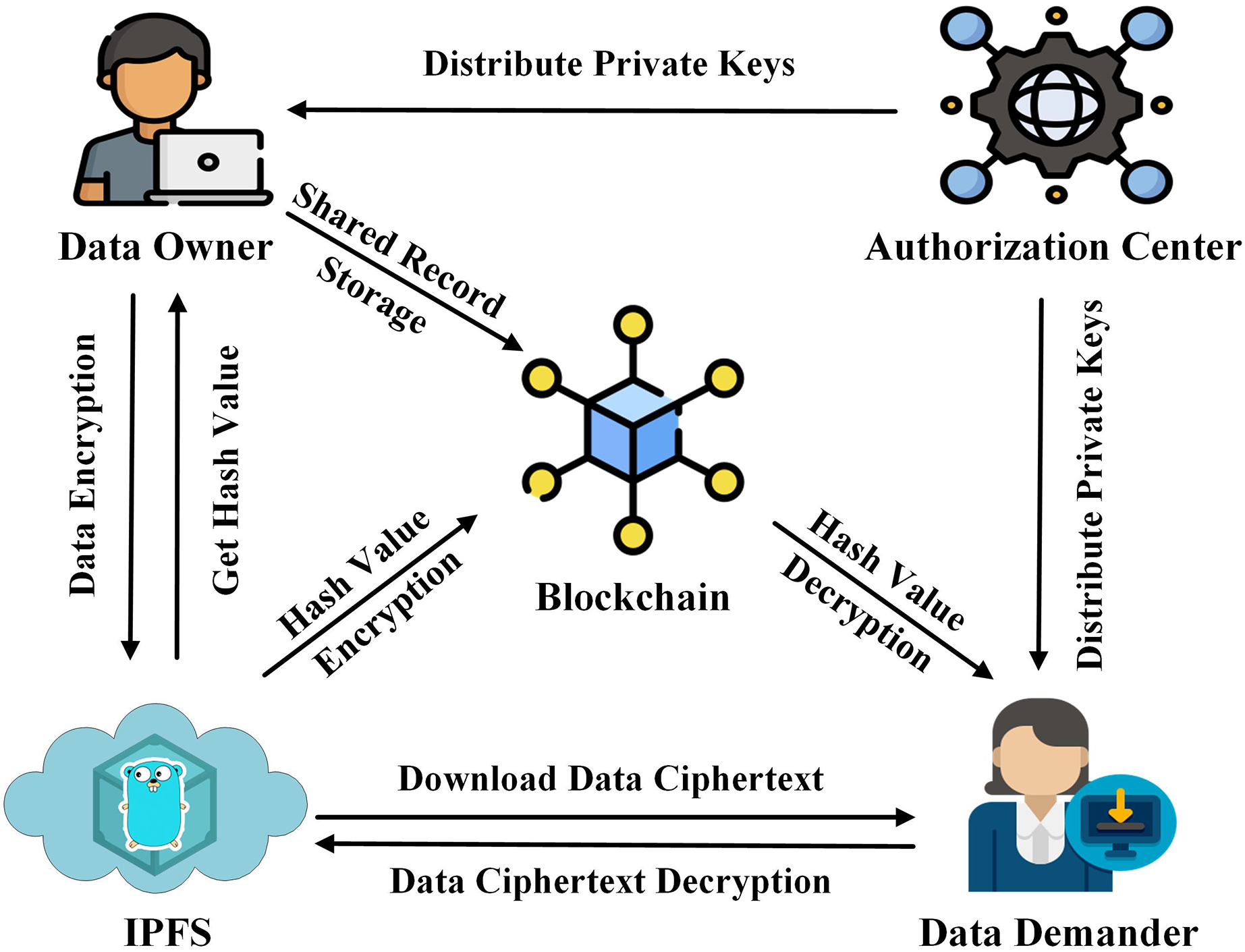

Ethereum ETFs, or Exchange-Traded Funds, are investment funds that hold Ethereum as their underlying asset, allowing investors to gain exposure to this popular cryptocurrency without directly purchasing it. The primary purpose of Ethereum ETFs is to provide a regulated and easily accessible way for both retail and institutional investors to invest in Ethereum, thereby enhancing liquidity and attracting more capital into the cryptocurrency market.

There are several types of Ethereum ETFs available in the market today, including physically-backed ETFs that directly hold Ethereum, and futures-based ETFs which invest in Ethereum futures contracts. The regulatory environment surrounding Ethereum ETFs has evolved, with various jurisdictions establishing frameworks for their operation, aimed at ensuring investor protection while fostering innovation within the crypto space.

Criteria for Evaluating Ethereum ETFs

When evaluating Ethereum ETFs, investors should consider several key factors to make informed decisions. These criteria include:

- Liquidity: The ease with which an ETF can be bought or sold in the market, which is crucial for investors looking to enter or exit positions swiftly.

- Trading Volume: A higher trading volume generally indicates better liquidity and can be an indicator of the ETF's popularity among investors.

- Expense Ratios: The annual fees charged by the ETF, which can significantly affect net returns over time. Lower expense ratios are generally more favorable.

- Management Fees: Fees paid to the fund managers for their services. These should be compared across different ETFs to identify the most cost-effective options.

Assessing liquidity and trading volume can be done by reviewing market data and historical performance of the ETF, while expense ratios and management fees are typically listed in the ETF's prospectus.

Comparison of Leading Ethereum ETFs

To help investors differentiate between the top Ethereum ETFs, here is a comparison table based on performance metrics such as expense ratio, trading volume, and historical returns:

| ETF Name | Expense Ratio | Average Trading Volume | 1-Year Return |

|---|---|---|---|

| Ethereum ETF A | 0.50% | 1,000,000 shares | 150% |

| Ethereum ETF B | 0.75% | 750,000 shares | 120% |

| Ethereum ETF C | 0.30% | 1,500,000 shares | 175% |

Each of these ETFs has unique features and benefits. For instance, Ethereum ETF A may appeal to investors looking for a moderate expense ratio with solid returns, while Ethereum ETF C stands out for its exceptionally low expense ratio and higher trading volume, making it a strong contender for cost-conscious investors.

Risk Analysis of Ethereum ETFs

Investing in Ethereum ETFs comes with several potential risks that investors should be aware of. The primary risk is the inherent volatility of Ethereum itself, which can lead to significant price fluctuations. Such volatility can directly affect the performance of the ETF, potentially resulting in rapid gains or losses for investors.Strategies for mitigating these risks include:

- Diversification: Investing in a mix of asset classes and not just Ethereum ETFs can help reduce overall portfolio risk.

- Dollar-Cost Averaging: Regularly investing a fixed amount in the ETF regardless of its price can help smooth out purchase costs over time.

- Setting Stop-Loss Orders: Implementing stop-loss orders can protect against significant losses by automatically selling the ETF when it reaches a certain price.

Investment Strategies for Ethereum ETFs

There are various investment strategies that can be employed when focusing on Ethereum ETFs. Long-term investors may adopt a buy-and-hold strategy, taking advantage of Ethereum's potential growth over time, while short-term traders may capitalize on price fluctuations for quick gains.For example, a long-term investment approach might involve purchasing Ethereum ETFs during market dips and holding them to benefit from long-term appreciation.

Conversely, a short-term approach could involve frequent trading based on market trends and price momentum.Furthermore, portfolio diversification can be achieved by incorporating Ethereum ETFs along with traditional assets like stocks and bonds, balancing risk and potential returns.

Future Trends in Ethereum ETFs

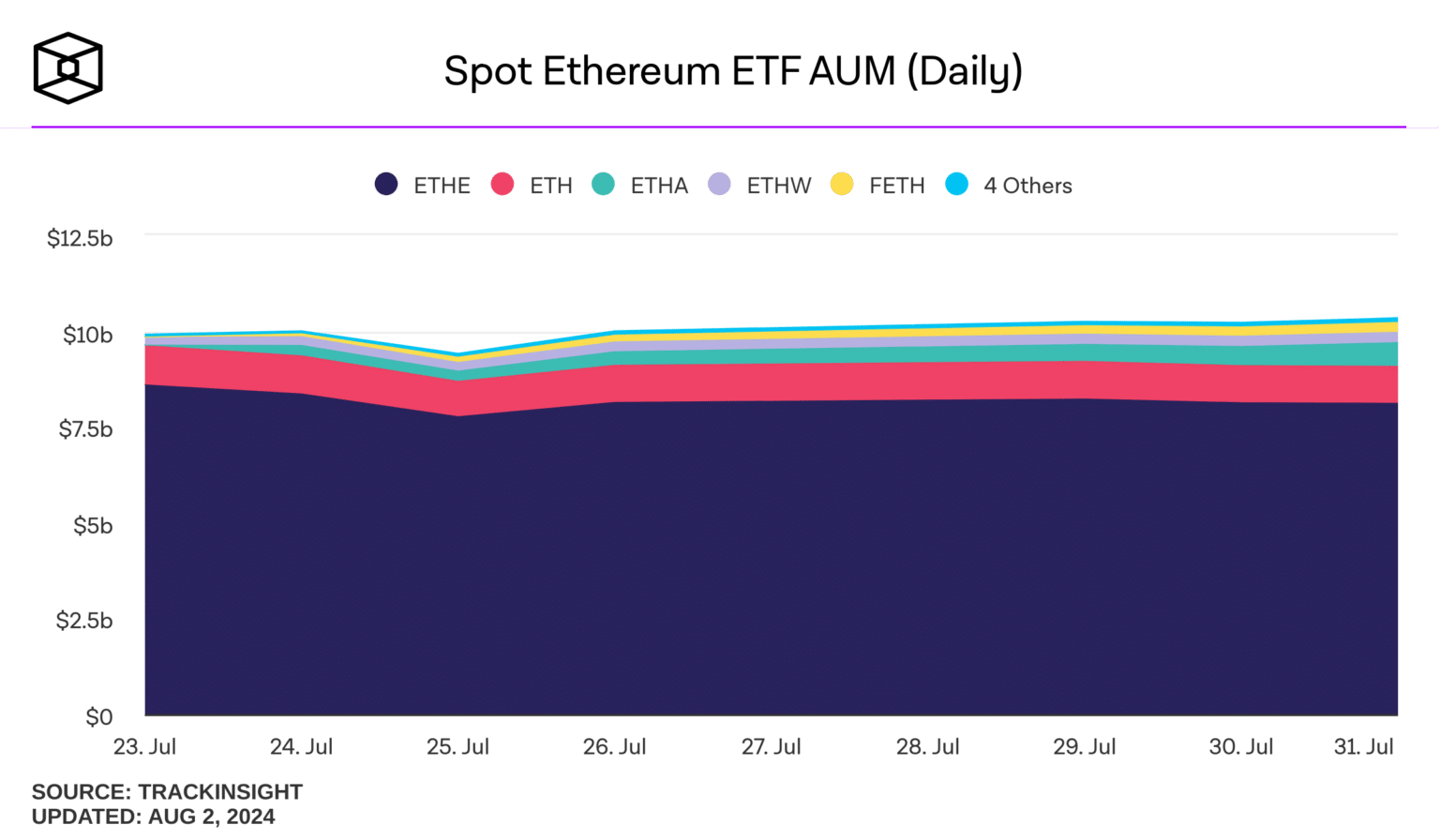

The Ethereum ETF market is expected to experience several emerging trends in the coming years. One significant trend is the increasing adoption of blockchain technology across various sectors, which could drive further interest and investment in Ethereum ETFs.Technological advancements, such as the transition from proof-of-work to proof-of-stake in the Ethereum network, may also impact the efficiency and appeal of Ethereum ETFs.

As the ecosystem matures and regulatory frameworks solidify, predictions suggest substantial growth in Ethereum ETFs, potentially leading to a broader acceptance among mainstream investors.As institutional investments continue to grow, the overall market for Ethereum ETFs is likely to expand, offering more diverse options and innovative products tailored to a variety of investor needs and risk appetites.

Final Thoughts

In conclusion, determining which ethereum etf is best involves analyzing various factors, including performance, costs, and market trends. As we move forward, staying informed about the evolving landscape of Ethereum ETFs will empower investors to make strategic decisions. Whether you are inclined towards short-term gains or long-term growth, understanding these dynamics can help optimize your investment strategy in this fast-paced market.

FAQ Overview

What are the benefits of investing in Ethereum ETFs?

Ethereum ETFs provide exposure to Ethereum's price movements without the need to directly hold the cryptocurrency, offering diversification and convenience.

How do expense ratios affect my investment in Ethereum ETFs?

Expense ratios indicate the cost of managing the ETF, with lower ratios allowing more of your investment to work for you over time.

Are Ethereum ETFs suitable for long-term investments?

Yes, Ethereum ETFs can be suitable for long-term investments, especially for those who believe in the future growth of Ethereum and blockchain technology.

What risks should I be aware of when investing in Ethereum ETFs?

Investors should consider market volatility, regulatory changes, and the overall performance of Ethereum when assessing risks associated with these ETFs.

How can I assess the liquidity of an Ethereum ETF?

Liquidity can be assessed by looking at the trading volume and the bid-ask spread, which indicate how easily the ETF can be bought or sold in the market.